Our very own Peter Dowlen - as well as insuring Hot Air Balloons has now made cartoon history.

In a recent interview with Editor, Richard Wiles from Aerostat magazine Peter reveals all about his ballooning career.

You can read the interview in full here.

The statistics:

Name Peter Dowlen (Piggy)

Age: 65 years young

Location: Chilterns

Profession: Chartered Insurance Broker

BBAC Affiliated club: The Black Horse Ballooning Club

Syndicate/team Bennett Balloon Team

Pilot level/s and rating: CPL

Number of flying hours: Approaching 1,600 hours.

How did you get into ballooning?

I started through a friend in 1976, who learned to fly at Cirencester Agricultural College. I was always interested in aviation and, as an Air Cadet, I was lucky enough to fly Chipmunks, which whetted my appetite. After leaving school, I carried on flying fixed wing building up hours to get my PPL.

What are your memories of your first balloon flight?

It was 16th October 1976, with my friend Rob fuller. We landed in a tree. It was in Snapdragon, G-BCRE, a Cameron 0-77 with a Velcro rip. We were fortunate that the tree was opposite the Dog & Pheasant pub in Brook, near Godalming, Surrey. They had just opened as we finished packing away. I seem to remember being driven home after we were shown the door at closing time. I thought, this is great fun! I never went back to fixed wing after that.

Who did you train and check out with?

Robert Fuller and Andrew Langton. After the first flight, I bought two shares in the Snapdragon Syndicate. My instructor flights were with David Liddiard and check out was with Wing Commander Gerry Turnbull.

How long did it take to get your licence?

It took three years -marriage to my wife Gail, in 1978 intervened, so it could have been quicker.

How did you find the ground exams?

Fun. It was Gerry Turnbull at his house in Radlett. We became friends and his son, Richard and i sometimes fly together, as we share balloon insurance.

How was your first solo flight?

It was shortly after my check flight with Gerry back in October 1979. It was interesting to say the least, as I used the trail rope landing. Bad idea on your own in a 77 with a Velcro rip. I went up again, but fortunately the crew were fit and ran across the field and grabbed the line and got me down.

How did you get involved in balloon insurance?

It was following my joining the Snapdragon Syndicate. I was already working in insurance, which helped me to get to know the market and start work to design our own scheme. When I joined J Bennett & Son in 1984, we insured several balloons with General Italy and Lloyds of London. The first J Bennett balloon came on the scene in the Summer of 87, which sparked the growth of our Balloon Insurance business, culminating in us finally creating our own scheme, with our own wording and claims handling facility.

How many balloonists does J Bennett & Son insure?

We have approaching 200 policies and insure over 500 balloons. It is a real mix of private and commercial balloonists. From a small hopper up to 16 passenger public transport balloons.

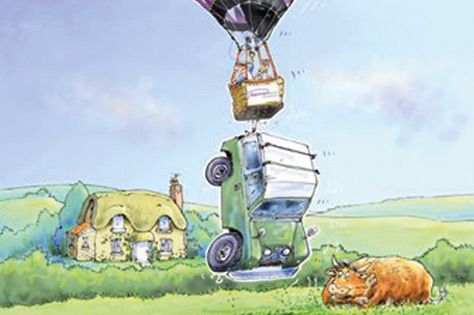

You're the inspiration for a new series of adverts for J Bennett & Son, illustrated by cartoonist Rupert Besley: how did that come about?

From the team in the office, my nickname, my adventures, and of course how my crew (specifically Mary Sanders), have to get me out of scrapes. it's a lovely compliment and Rupert is an excellent cartoonist. We were lucky to find him.

What do you find the most difficult about ballooning?

The fickleness of the British weather, but with the keenness and loyalty of a local crew, we usually get lucky. If we meet and the wind doesn't drop, the Black Horse in Great Missenden serves excellent ales from a local Client, the Rebellion Brewery Company, in Marlow.

What was your most memorable flight?

There have been a number, but probably it was the flight over the English Channel with Mary in 1992. Sixty-two other balloons under the supervision of ace organiser, Derek Belton, flew a charity event, most landing at Calais airport after a two-hour flight. we landed at the far end of the runway and enjoyed some champagne whilst we awaited retrieval. By the time we got into the terminal, the other pilots had finished all the beer!

What was your most scary moment?

It was during a thunderstorm in Holland. An 'expert' met guy from Amsterdam's Schiphol Airport had assured us, when giving the met, that there was no thunder in the vicinity. Five minutes after take off, we found out how wrong he was, and we had to make an emergency landing into a cow field, just missing all the cows. Fortunately, I had tow very large German ladies on board and the basket stopped quickly and the envelope deflated almost immediately. Thirty seconds after that, there was a bright flash and then a huge clap of thunder, followed by gusts well over 30 knots. We got soaked, but were safe.

What appeals most about ballooning?

The freedom and camaraderie and all those serendipity moments.

What irritates most about ballooning?

Unnecessary regulation and paperwork

Where have you flown abroad?

Ireland, Holland, France, Germany, Italy, Austria and USA, and of course all over the UK.

What's your favourite balloon event?

There are too many to mention, but high on the list would be The Irish Meet, Twente Ballooning and latterly Todi. I have attended every Irish Championships since 1985.

What balloons do you currently fly?

Current balloon, a Cameron Z-90, G-CUB and an older envelope is a Cameron N-105, G-OJBS. Both are affectionately call Bennett.

Who are your regular crew?

Mary Sanders, Bex Chitty, Patrick and Robert Lunt and, on occasions, my son Chris.

How often do you fly?

I used to fly about eighty times a year and it's now down to about thirty. Quality, not quantity as you get older.

Have you any experience of gas ballooning or airships?

I was lucky enough to fly in a gas balloon at Twente Ballooning. It is my only gas flight so far, a fantastic experience, taking off in the middle of the night, able to hear all the sounds around you, without interruption from a burner of pilot light.

What's your favourite ballooning anecdote?

I heard a story where a fellow balloonist flew in fog. The forecaster said the fog would lift shortly, so our intrepid pilot, fully believing the forecast, took off. After an hour's flight, the fog had got much worse, but he decided to gingerly start a descent. As he was tapping his altimeter to check height, he had the misfortunate to see the ground coming up fast. He grabbed the burners, with both hands and started to burn, turning on all taps. But it was too late. In his path, looming through the fog, was a greenhouse, followed by a large vegetable patch and a beautiful row of runner beans, in full bloom. Next, the silence of the day was broken by the crashing glass, mixed with 24 million BTU's of propane shooting up into the envelope. The basket continued through the greenhouse and then into the beans.

The continual burning at last started to work. Wrenching the entire row of beans form the ground, stalks and all, our pilot is now approaching the house, at the same time as trying to extract the bean system. At roof level, he neatly pushed all the canes holding the beans off the basket and over the apex of the house. Our pilot then disappears like a cork out of water, into the blue sky and safety. Twenty minutes later the fog begins to clear and safe landing is made. I often wonder what the householder thought, as they woke to find the carnage outside and on the roof.

What are your ballooning goals?

Purely to enjoy myself safely and carry on as long as I can, health and regulations permitting.

What's your passion outside of ballooning?

All country sports, allotment gardening, motorcycling and cooking. I also enjoy nice meals, including fine wine and travel.

Cartoon Credit: Rupert Besley